TechnicalIndicators

A javascript technical indicators written in typescript.

Installation

Node.js versions >= 10

npm install --save technicalindicatorsconst SMA = require('technicalindicators').SMA;Node.js versions < 10

For nodejs version below 10 use 1.x versions of this library.

Webpack

Make sure you have the following in your config file.

module.exports = {

resolve: {

mainFields: ["module", "main"]

}

}Browser

For browsers install using npm,

For ES6 browsers use

npm install --save technicalindicators<script src="node_modules/technicalindicators/dist/browser.es6.js"></script>For ES5 support it is necessary to include the babel-polyfill and respective file browser.js otherwise you will get an error. For example see index.html

npm install --save technicalindicators

npm install --save babel-polyfill<script src="node_modules/babel-polyfill/browser.js"></script>

<script src="node_modules/technicalindicators/dist/browser.js"></script>Pattern detection

Pattern detection is removed from version 3.0, if you need pattern detection use v2.0

All indicators will be available in window object. So you can just use

sma({period : 5, values : [1,2,3,4,5,6,7,8,9], reversedInput : true});or

SMA.calculate({period : 5, values : [1,2,3,4,5,6,7,8,9]});Playground

Playground with code completion

Crypto Trading hub

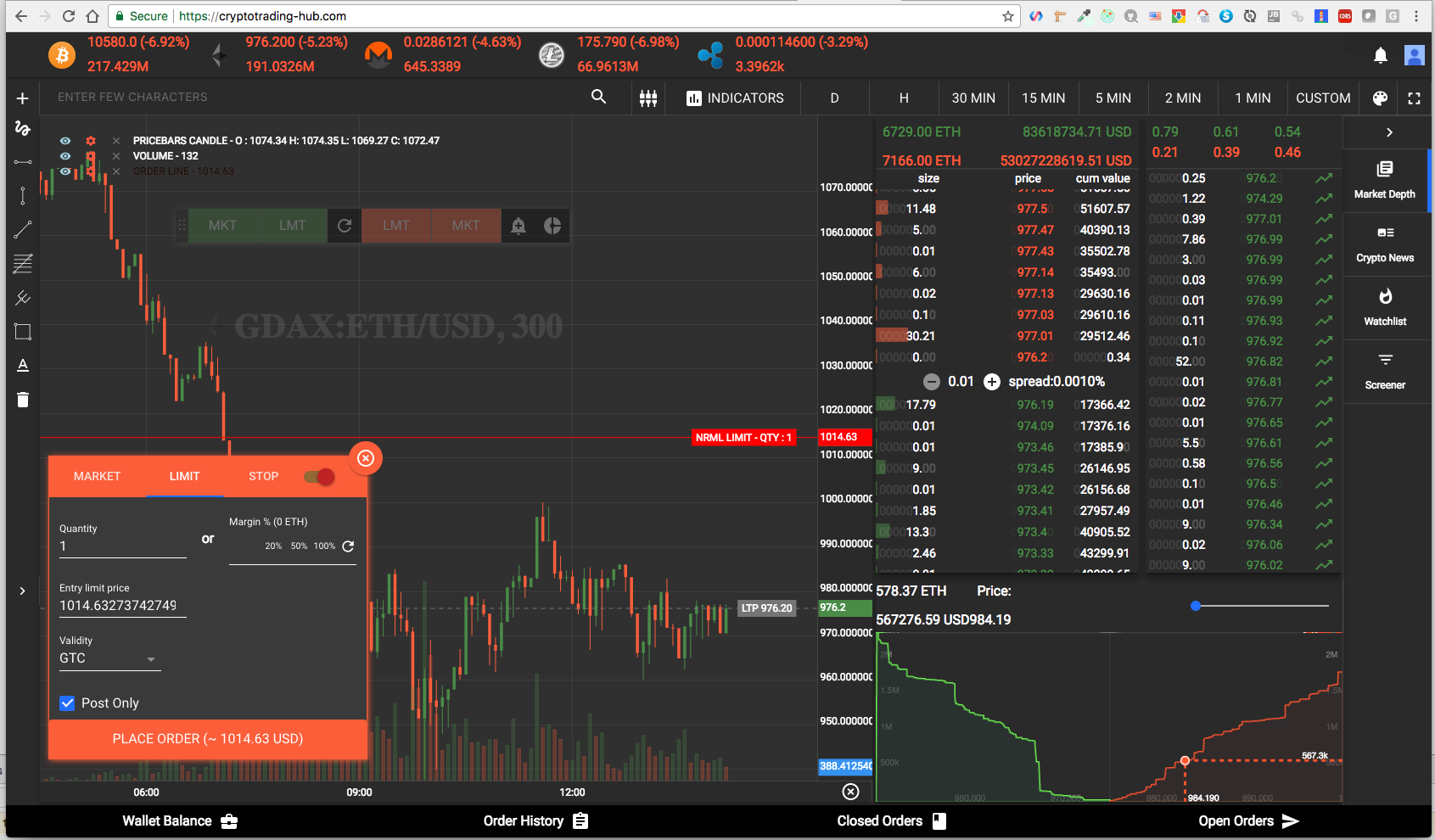

If you like this project. You'll love my other project crypto trading hub

- Its free

- Realtime price charts

- Unified trading experience across exchanges

- Price alerts

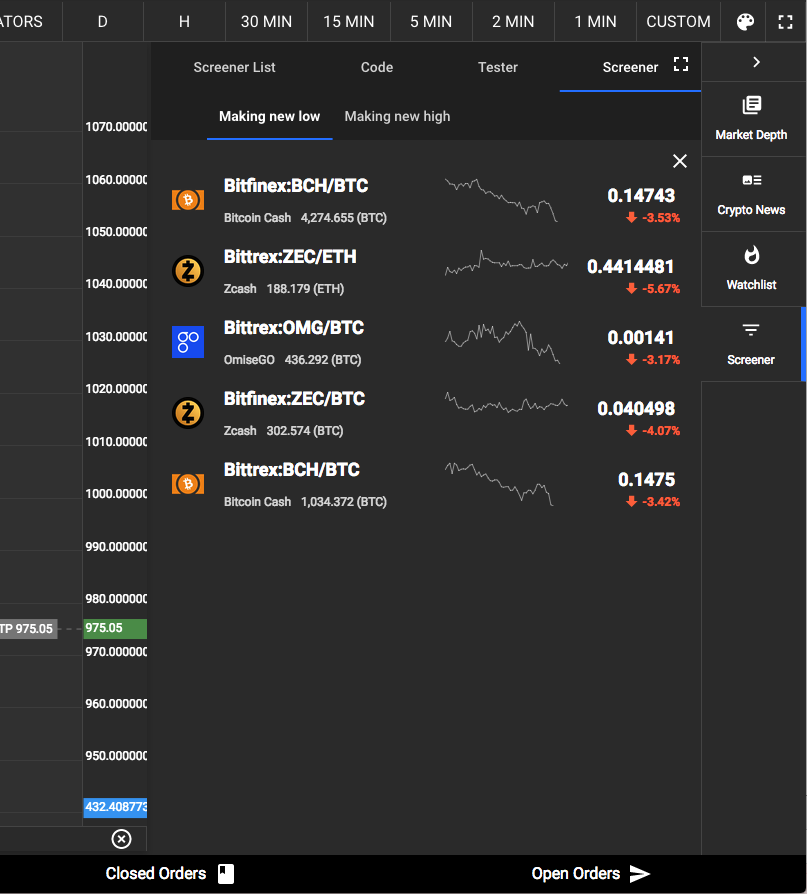

- Realtime crypto screening using javascript (Find coins making high and low in realtime or anything you can write using this library and javascript in realtime)

- Trading from charts,

- Modify orders and ability to trade and create studies using javascript.

Available Indicators

- Accumulation Distribution Line (ADL).

- Average Directional Index (ADX).

- Average True Range (ATR).

- Awesome Oscillator (AO).

- Bollinger Bands (BB).

- Commodity Channel Index (CCI).

- Force Index (FI).

- Know Sure Thing (KST).

- Moneyflow Index (MFI).

- Moving Average Convergence Divergence (MACD).

- On Balance Volume (OBV).

- Parabolic Stop and Reverse (PSAR).

- Rate of Change (ROC).

- Relative Strength Index (RSI).

- Simple Moving Average (SMA).

- Stochastic Oscillator (KD).

- Stochastic RSI (StochRSI).

- Triple Exponentially Smoothed Average (TRIX).

- Typical Price.

- Volume Weighted Average Price (VWAP).

- Volume Profile (VP).

- Exponential Moving Average (EMA).

- Weighted Moving Average (WMA).

- Wilder’s Smoothing (Smoothed Moving Average, WEMA).

- WilliamsR (W%R).

- Ichimoku Cloud.

Other Utils

Chart Types

CandleStick Pattern

- Abandoned Baby.

- Bearish Engulfing Pattern.

- Bullish Engulfiing Pattern.

- Dark Cloud Cover.

- Downside Tasuki Gap.

- Doji.

- DragonFly Doji.

- GraveStone Doji.

- BullishHarami.

- Bearish Harami Cross.

- Bullish Harami Cross.

- Bullish Marubozu.

- Bearish Marubozu.

- Evening Doji Star.

- Evening Star.

- Bearish Harami.

- Piercing Line.

- Bullish Spinning Top.

- Bearish Spinning Top.

- Morning Doji Star.

- Morning Star.

- Three Black Crows.

- Three White Soldiers.

- Bullish Hammer.

- Bearish Hammer.

- Bullish Inverted Hammer.

- Bearish Inverted Hammer.

- Hammer Pattern.

- Hammer Pattern (Unconfirmed).

- Hanging Man.

- Hanging Man (Unconfirmed).

- Shooting Star.

- Shooting Star (Unconfirmed).

- Tweezer Top.

- Tweezer Bottom.

or

Search for all bullish or bearish using

var twoDayBullishInput = {

open: [23.25,15.36],

high: [25.10,30.87],

close: [21.44,27.89],

low: [20.82,14.93],

}

var bullish = require('technicalindicators').bullish;

bullish(twoDayBullishInput) //trueAPI

There are three ways you can use to get the indicator results.

calculate

Every indicator has a static method calculate which can be used to calculate the indicator without creating an object.

const sma = require('technicalindicators').sma;

var prices = [1,2,3,4,5,6,7,8,9,10,12,13,15];

var period = 10;

sma({period : period, values : prices})or

const SMA = require('technicalindicators').SMA;

var prices = [1,2,3,4,5,6,7,8,9,10,12,13,15];

var period = 10;

SMA.calculate({period : period, values : prices})nextValue

nextValue method is used to get the next indicator value.

var sma = new SMA({period : period, values : []});

var results = [];

prices.forEach(price => {

var result = sma.nextValue(price);

if(result)

results.push(result)

});getResult

This a merge of calculate and nextValue. The usual use case would be

-

Initialize indicator with available price value

-

Get results for initialized values

-

Use nextValue to get next indicator values for further tick.

var sma = new SMA({period : period, values : prices}); sma.getResult(); // [5.5, 6.6, 7.7, 8.9] sma.nextValue(16); // 10.1

Note: Calling nextValue will not update getResult() value.

Precision

This uses regular javascript numbers, so there can be rounding errors which are negligible for a technical indicators, you can set precision by using the below config. By default there is no precision set.

const technicalIndicators = require('technicalindicators');

technicalIndicators.setConfig('precision', 10);Contribute

Create issues about anything you want to report, change of API's, or request for adding new indicators. You can also create pull request with new indicators.

Environment dependencies

Typescript: Use typescript 2.0.0 other you might get max call stack reached error.

npm install -g typescript@2.0.0

TechnicalIndicators depends on the canvas package, which requires some dependencies to be installed. You can find the instructions to do that here. If you do not install these dependencies, expect to get this error message during the installation of TechnicalIndicators:

> canvas@1.6.6 install /Users/balupton/Projects/trading/technicalindicators/node_modules/canvas

> node-gyp rebuild

./util/has_lib.sh: line 31: pkg-config: command not found

gyp: Call to './util/has_lib.sh freetype' returned exit status 0 while in binding.gyp. while trying to load binding.gyp

Setup

git clone git@github.com:anandanand84/technicalindicators.git # or use your fork

cd technicalindicators

npm run startRunning tests and getting coverage

npm test

npm run coverAdding new indicators

- Add tests for the indicator and make them pass.

(It would be better if a sample of the stockcharts excel is used for the test case.) - Add the indicator to the

index.jsandsrc/index.ts - Run build scripts:

npm run build-lib && npm run generateDts && npm run start - Add it to

README.md, with the link to the runkit url containing the sample. - Add indicator it to keywords in

package.jsonandbower.json - Send a Pull Request.

Verify Documentation

node testdocs.js

open "http://localhost:5444/testdocs.html"Donate

- XRB:

xrb_1shh8i77upiq4bjzi3ajik9ofq14bbcucshoapi3m7f8d74dc5k31o56yj5r - ETH:

0x0B56580Eb25f3F7e366dDA697161d314C17Bcb6a - LTC:

LLTUhKBRKs9sbW9F8MFQm7VVdZ1dJnXzGc - BTC:

1FGeJHoj7tjeLrm4JNtyPWTdBKPJjcqP6Y - BCH:

1AUFc8CEfHVjnoixbqTbX62WV8DZkpC1DU